For me, a big part of a satisfying work life is making sure my money is right. I’ve always had good money sense, but there are definitely levels to earning and growing your money and I want to buckle down even more to make some gains in the next year. October is typically a good time for me to check in with my finances because there’s enough of a lull in my schedule for me to assess and address any concerns I may have. My natural rhythm is to a) scale back my spending in anticipation of the annual bills that will come in (i.e. property taxes, home insurance, HOA, etc.) and b) update my budget spreadsheet for next year. Lately though, I’ve been focusing on my retirement savings. Even though I contribute a portion of my paycheck to a 401k/IRA each pay period, I feel it’s easy to get complacent because ‘retirement’ sounds so far away. But time really does fly, and as you close out year 6, 10, 18, etc. of your career the mirage of retirement begins to come into focus….quickly (and sharply).

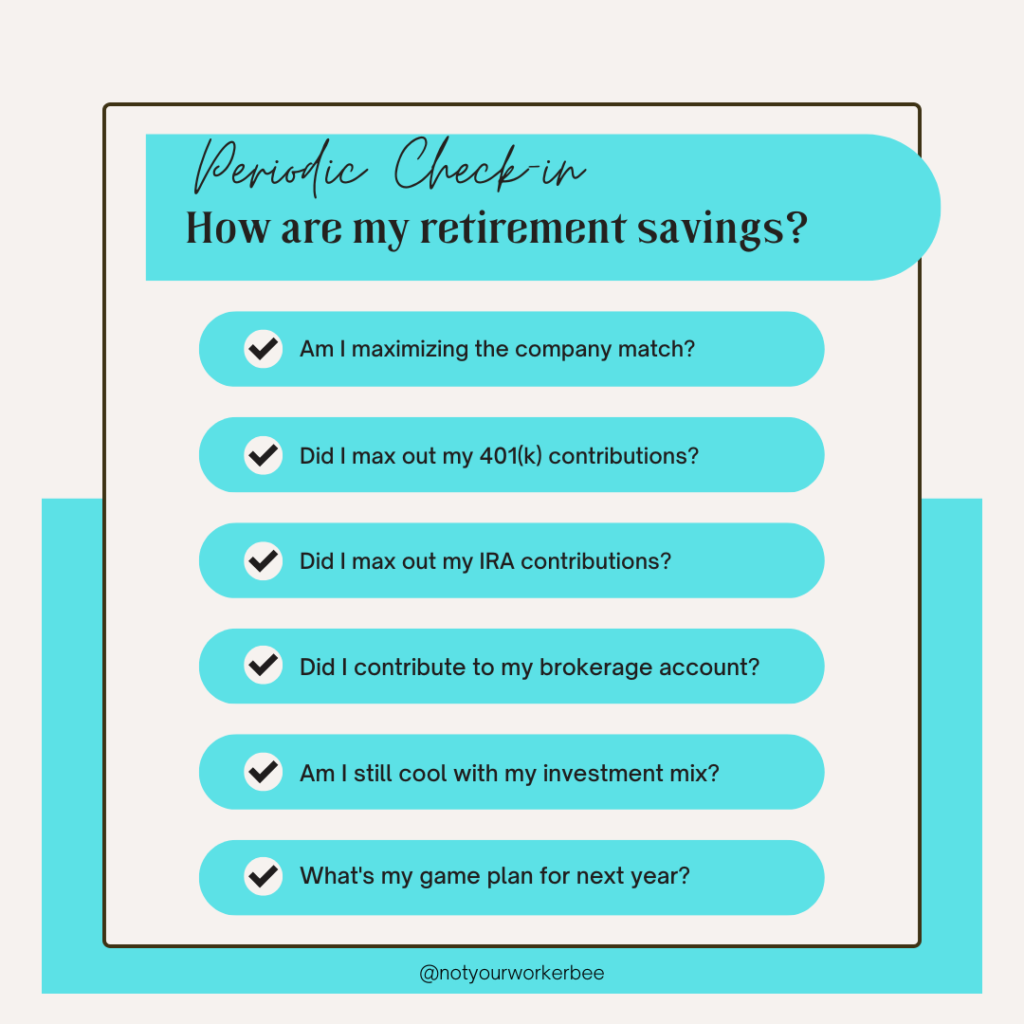

Below are a few questions I ask myself to gauge how I’m doing on my retirement goals.

1. Am I maximizing the company match?

Yes…the answer is always yes. There is never a time where free money is left on the table when it comes to an employer match. I don’t care what the employer match percentage is, I always contribute at least that amount (and then some).

2. Did I max out my 401(k) contributions?

Depends. The IRS contribution limit can change each year so it’s best to confirm the amount via their website — for 2022 the limit is $20,500 (if under 50). I measure my progress by summing up all the 401k contributions that are deducted from my paycheck each pay period. If the company has an employer contribution match, I add that to the total also to see where I shake out. If I’m under the limit by October, I consider either upping my contribution percentage from my paycheck or leaving everything as is and transferring cash from my savings to my personal IRA and/or brokerage accounts.

3. Did I max out my IRA contributions?

Depends. The IRS contribution limit may change each year so it’s best to reconfirm this amount via their website too—for 2022 the limit is $6,000 for both traditional and Roth IRAs (if under 50). Some years I contribute a set amount each quarter, and some years I can make the max contribution all at once. If I’m under the limit by October I don’t stress out about it because I can make additional contributions through April of next year. Generally speaking, you have until the tax return filing date to make IRA contributions for the prior year. In other words, I have until April 18, 2023 to contribute up to $6,000 to my IRA for the 2022 tax year.

4. Did I contribute to my brokerage account?

Sometimes. Admittedly, I haven’t always been super active with my brokerage account but I’m looking to change that going forward. I’ve done better than I have in previous years, but I want to be more consistent.

The stock market has been trending down this year. The Dow Jones (DJIA) started at 36,585.06 at the top of this year, and as of Sept. 30, closed at 28,725.51 points. With stock prices dipping, and no one really knowing when it’s going to bottom out, I’ve been stashing extra cash in my brokerage account so I can be ready to scoop up more stocks/funds at cheaper prices.

5. Am I still cool with my investment mix?

Yes. I typically have a mix of large, mid and small cap funds across all my retirement accounts. My brokerage account has a similar mix along with more individual stocks. If you’re not comfortable with buying individual stocks, it’s okay to find no/low cost mutual funds to invest in. Check out major investment firms’ websites (i.e. Fidelity, TD Ameritrade, Vanguard, Charles Schwab…) to see which funds are available and line up with your goals.

6. What’s my game plan for next year?

This is when I refresh my budget for the next year and decide what I want to accomplish. The mantra for me is to maintain and gain (in that order). Some years are just about maintaining and others are about leveling up in some incremental capacity. Sometimes I resolve to save more in emergency, on-hand cash or contribute more to my retirement. Other times I’m eyeing a promotion or strategizing how to secure a pay raise.

At the end of the day, I don’t want to be one of the people included in the common refrain of “Americans don’t save enough for retirement” so I try to do this check in at least twice a year. If I’m able to max out contributions for both my 401(k) and IRA accounts, I consider it an accomplishment. If I can save above and beyond that, then I feel even more confident that I’m on track. And for those times where I fall short of my annual goal, I do my best to rebound quickly so I don’t lose too much ground in the long run. Financial security doesn’t just happen — it requires effort and discipline, so the sooner you can say ‘yes’ to each of the items on this list, the closer to a work-optional lifestyle you will get.